Small businesses working to make their websites more accessible to people with disabilities may be eligible for significant tax benefits through the IRS Disabled Access Credit. This opportunity can significantly reduce the cost of digital accessibility compliance and should be explored by any U.S. small business meeting the criteria.

Disclaimer

As with all things tax-related, please seek the advice of your CPA or tax professional before filing for the Disabled Access Credit. Nothing in this post should be considered financial or tax advice.

What Is the Disabled Access Credit?

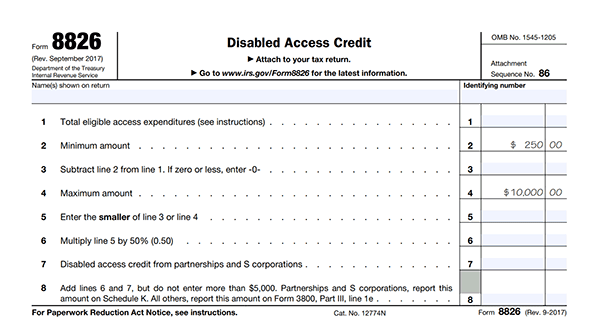

The Disabled Access Credit is a non-refundable tax credit available to eligible small businesses that incur expenses to provide access to persons with disabilities. Established as part of the Americans with Disabilities Act (ADA) of 1990, this credit is claimed using IRS Form 8826.

How Much Is the Tax Credit?

For eligible small businesses, the credit equals 50% of eligible accessibility expenditures that exceed $250 but do not exceed $10,250 for a given tax year. This means the maximum credit available is $5,000 per year ($10,000 × 50%).

For example, let’s say a small business hires an accessibility consultant to undertake an accessibility audit of their website and remediation of all its reported accessibility issues. The final cost was $5,000. The business would be allowed a tax credit of (($5,000 – $250) / 2) or $2,375 which is just under 50% of the total cost of the project. Half off is pretty sweet.

Note:

This tax credit can be taken every year that suitable expenses are incurred. So, if your accessibility project falls over two tax years, or if you pay annual costs for tools which help your staff maintain the accessibility of your website and related documents, a tax credit is available if those expenses exceed $250/yr.

Who Qualifies as an Eligible Small Business?

To qualify for the Disabled Access Credit, a business must:

- Have earned $1 million or less in gross receipts for the preceding tax year, OR

- Had no more than 30 full-time employees during the preceding tax year (as per Form 8826, “An employee is considered full time if employed at least 30 hours per week for 20 or more calendar weeks in the tax year”)

How to Claim the Credit Using Form 8826

To claim the Disabled Access Credit:

- Complete IRS Form 8826, available at https://www.irs.gov/forms-pubs/about-form-8826

- Calculate your eligible accessibility expenditures for the tax year

- Subtract $250 from this amount

- Multiply the result by 50% and take the lesser of that result or $5,000

- Include the completed Form 8826 with your business tax return

Here’s a walkthrough of the form by Certified Financial Planner (CFP) Forrest Baumhover:

Website Accessibility and Software Product Accessibility as Eligible Expenses

While the IRS does not explicitly mention website accessibility in its examples of qualified expenses, digital accessibility efforts typically qualify under the broader category of “removing barriers that prevent a business from being accessible to persons with disabilities.”

While the IRS does not explicitly mention website accessibility in its examples of qualified expenses, digital accessibility efforts typically qualify under the broader category of “removing barriers that prevent a business from being accessible to persons with disabilities.”

Eligible website accessibility expenses might include:

- Accessibility audits and evaluations

- Manual testing services by disabled individuals

- Remediation services to fix accessibility issues

- Developer training on accessibility standards

- Screen reader compatibility adjustments

- Implementation and licenses for accessibility plugins or tools

- Captioning and audio description services

- PDF and document remediation

- Legal compliance consultation

- Ongoing monitoring services

- Accessibility statement creation

- Creating accessible documentation and help files

Applicability to Product and Software Accessibility

Many digital-first businesses, such as software-as-a-service (SaaS) product developers, may be able to use this tax credit to offset costs required to make their product offering accessible and compliant with various standards such as WCAG 2.2 or Section 508.

Note:

Given that this is an under discussed edge case, it is recommended that any business considering this path discuss the matter with a qualified tax professional.

According to IRS regulations in Publication 535 (Business Expenses) and the instructions for Form 8826, eligible expenditures include providing “qualified interpreters or other methods of making audio materials available to hearing-impaired individuals” and providing “qualified readers, taped texts, and other methods of making visual materials available to individuals with visual impairments” and lastly “acquire or modify equipment or devices for individuals with disabilities” (emphasis mine).

This means businesses might be eligible to claim the credit for a wide variety of accessibility improvements, such as:

- Redesigning the products UI/UX to be more accessible

- Creating accessible digital product interfaces

- Developing accessible user manuals and documentation

- Adding accessibility features to software products

- Retrofitting physical products with accessible controls or features

- Producing accessible versions of product materials

The key requirement is that these expenses must be incurred specifically to comply with ADA requirements and improve accessibility for individuals with disabilities.

The Business Case for Focusing on Website Accessibility

In addition to the tax benefits, website accessibility offers significant business advantages:

Expanded Customer Base:

- According to the CDC, approximately 28.7% of U.S. adults (approx. 75 million) have some type of disability.

- According to U.S. Census Bureau data, about 12.6% of people under retirement age (roughly 43.7 million individuals) live with one or more disabilities.

- Approximately 20.5% of undergraduate students (nearly 3.5 million students) report having a disability, according to the National Center for Education Statistics.

No matter your customer base, it is impacted by accessibility issues. Improving on those issues can lead to top line revenue growth and increased recurring business.

Legal Risk Mitigation:

Web accessibility lawsuits have increased dramatically over the last ten years. Over 8,800 federal ADA Title III website accessibility lawsuits were filed in 2024, up from approximately 8,227 in 2023 and a total of 42,181 in the period 2019-2022 according to the law firm Seyfarth Shaw’s analysis.

The majority of these cases were filed in California, New York, Florida, Texas, Illinois, Pennsylvania, Missouri, Minnesota, New Jersey and Georgia. So if you do business in those states, take notice.

Improved SEO and Potentially More Website Traffic:

Many accessibility best practices benefit search engine optimization. For example, adding proper alt text to images helps both screen reader users and search engine crawlers understand content, while semantic HTML improves both accessibility and SEO performance.

Increased Conversion Rates:

UK-based accessibility firm Click-Away Pound reported that inaccessible websites cost retailers approximately £17.1 billion in lost sales annually as consumers abandon purchases due to accessibility barriers.

Enhanced Brand Reputation:

Focusing on accessibility demonstrates corporate social responsibility and commitment to inclusion. A 2021 Accenture report titled “Life Reimagined: Mapping the motivations that matter for today’s consumers” found that current consumers prefer to purchase from brands that demonstrate inclusive practices and ~40% of those consumers would be willing to pay extra to maintain a business relationship with a provider or brand that takes visible action for a positive societal impact.

Best Practices for Documentation of Expenditures

To support your tax credit claim, maintain thorough documentation including:

- Detailed invoices for accessibility-related services

- Reports from accessibility audits

- Correspondence with accessibility consultants

- Before-and-after evidence of accessibility improvements

- Documentation connecting expenses to ADA compliance

References and Resources

IRS Form 8826 Instructions

https://www.irs.gov/forms-pubs/about-form-8826

ADA.gov Information on Tax Incentives

https://www.ada.gov/resources/tax-incentives-businesses/

Web Content Accessibility Guidelines (WCAG)

https://www.w3.org/WAI/standards-guidelines/wcag/

Section 508 Guidelines

https://www.section508.gov/

Tax Incentives for Improving Accessibility

https://archive.ada.gov/archive/taxpack.pdf

Thoughts?

Small businesses should really take note!

This tax credit is a great opportunity to help yourself while benefiting the public good and maintaining compliance with any legal and accessibility requirements.

If you’re business has considered filling, or successfully filed, using Form 8826, let me know in the comments below.

If you have questions about website accessibility and compliance, or related topics like issuing a VPAT for your products, get in touch.

Best of luck this tax season!